Asset Allocation

YOUR TEAM

Assembled to bring great capability to the investment process

Our team of financial professionals will work together help you meet your investment goals. Each member of the team plays an integral part, focusing on a defined role and area of responsibility.

Together, the team brings substantial capability and expertise to each step in the process.

As your Financial Advisor, we are here to guide you through every step of the investment process. As part of this process, we will assemble a team of professionals with expertise in investment management and specific asset allocation approaches, including professionals not typically accessible to individual investors.

Together, we will work through our multi-step Investment Process. This will provide us with a disciplined structure for implementing an investment strategy that is uniquely tailored for you.

INVESTOR

FINANCIAL ADVISOR

PORTFOLIO STRATEGIST

INVESTMENT MANAGEMENT FIRMS

ASSET ALLOCATION

How should you allocate your assets?

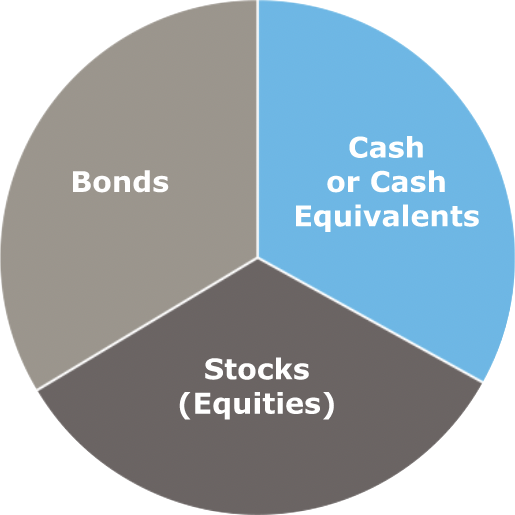

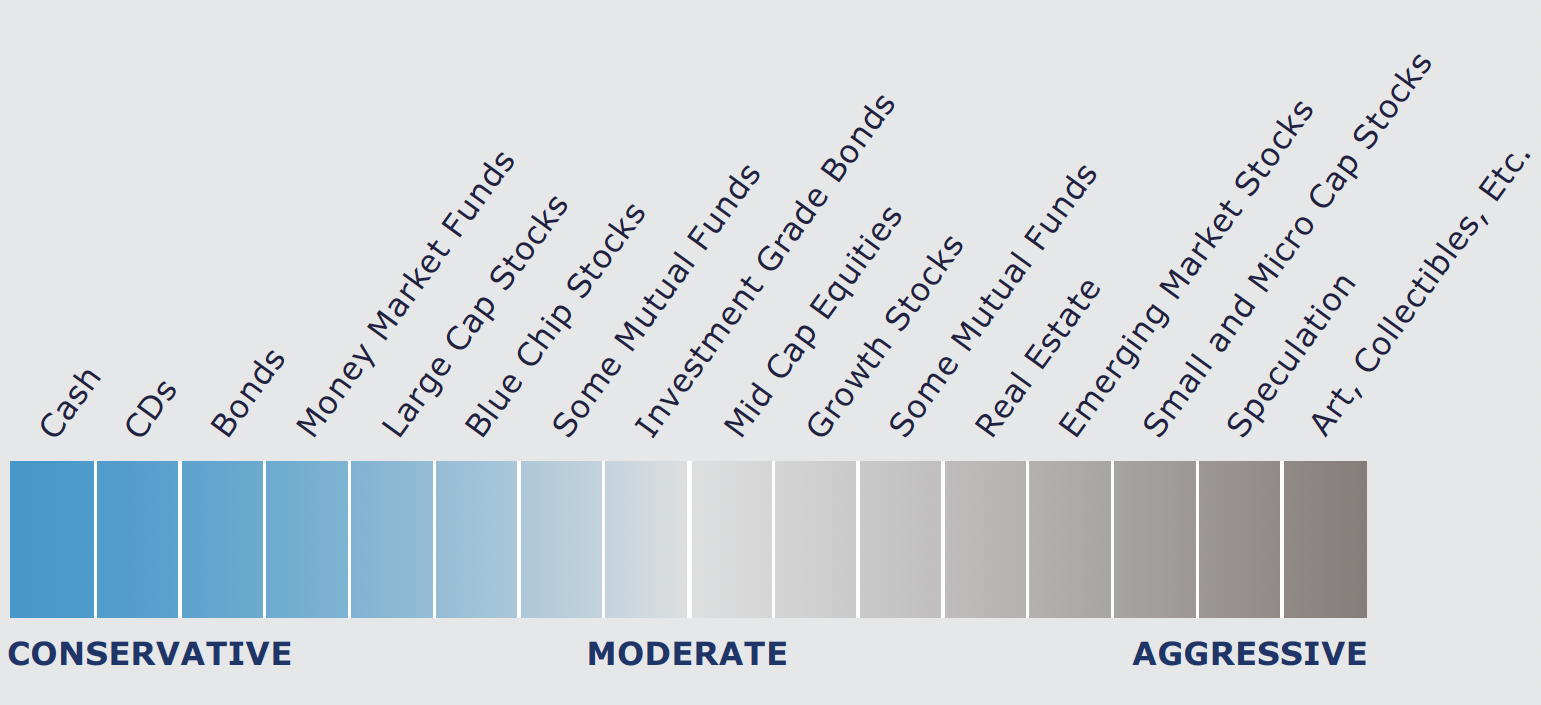

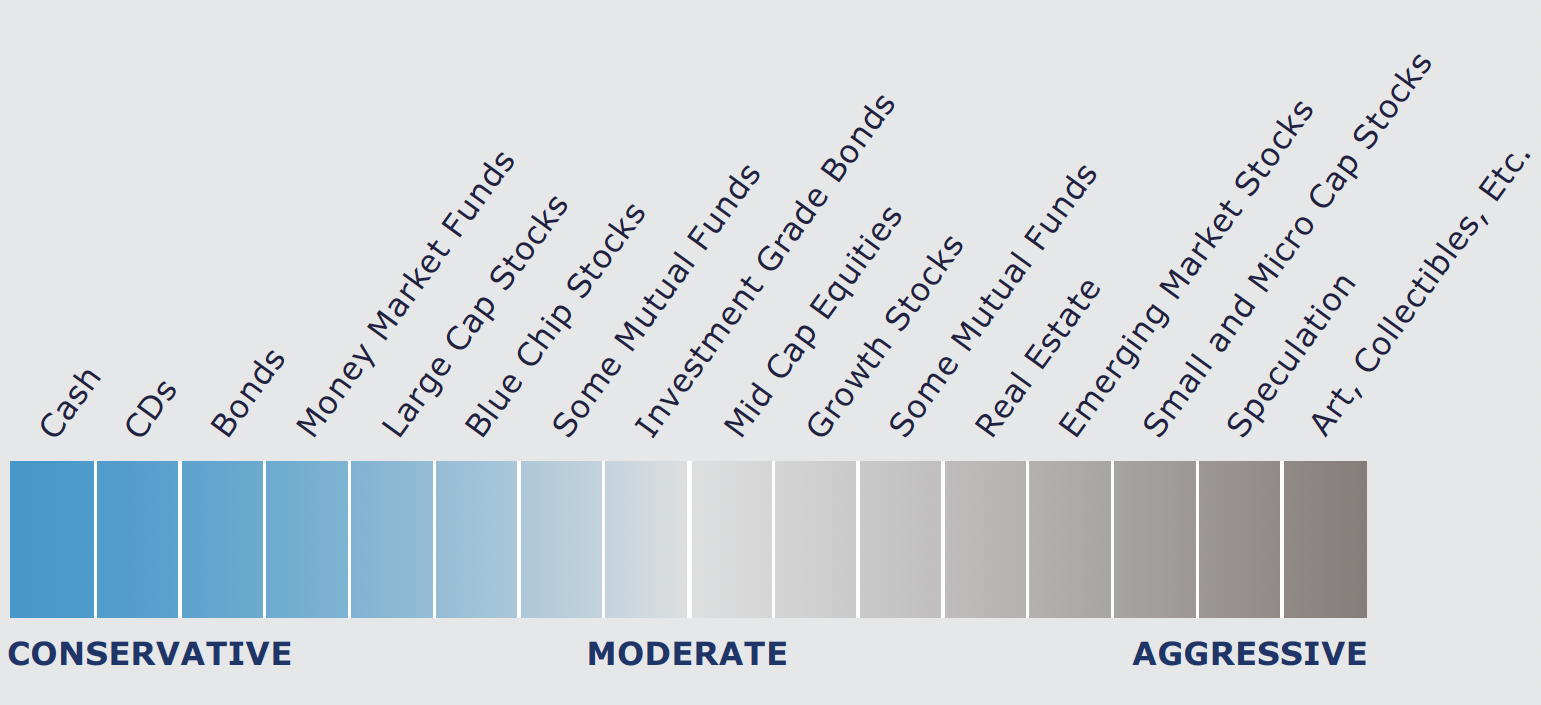

Most investors focus on individual security selection and often overlook the importance of asset allocation to their portfolios. Yet, studies have suggested that much of portfolio variance is determined by how your

assets are allocated among equity classes, fixed income securities and cash.

Various approaches may be suitable for different investment objectives, risk profiles, and market environments. They range from strategic asset

allocation approaches that attempt to capture long term market averages, to various tactical asset allocation approaches that are able to respond to shorter term opportunities and risks.

Whichever approach to asset allocation we incorporate, the goal will be the same: to keep your portfolio aligned with your investment goals.

FINANCIAL ANALYSIS

Understanding your needs, goals, and circumstances

What are your

investment goals?

What is your

risk tolerance?

What is your

time horizon?

What are your

investable resources?

What are your

liquidity needs?

What are your

income needs?

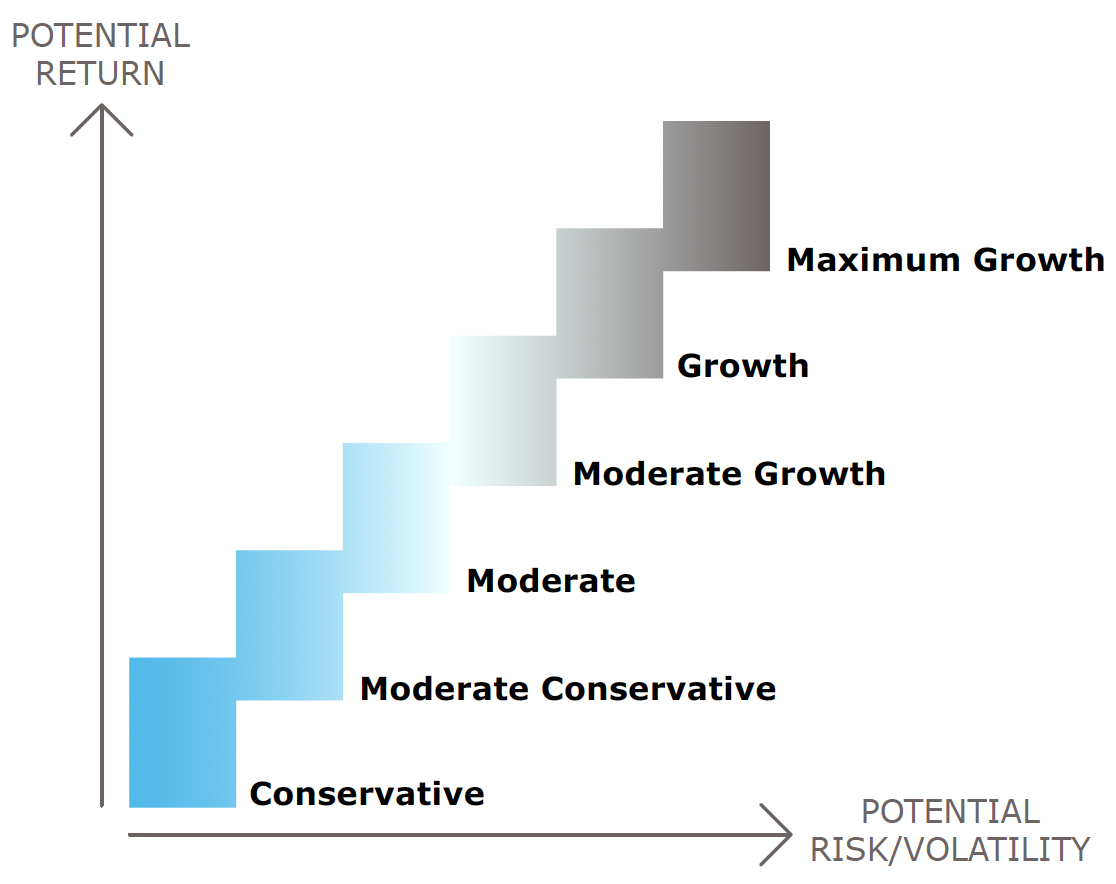

Matching your

financial goals to

1 to 6 risk/return

profiles.

Asset Allocation: An important determinant of variance in portfolio performance

Request A CONSULTATION

If you would like to learn more about Products and Services...